Bloomberg

6 minutes

High-profile designer moves show how much luxury is hurting

Bloomberg

December 31, 2024

Fashion people are obsessed with designer moves. Investors should be too. Earlier this month, Chanel named Matthieu Blazy, the creative director of Kering SA’s Bottega Veneta, as its new top designer in an unprecedented round of musical chairs that has also seen Hedi Slimane leave Celine and Kim Jones exit Fendi, both owned by LVMH Moet Hennessy Louis Vuitton SE.

Such high-level creative moves are indicative of the distress in the luxury sector, with demand this year expected to be the weakest since the financial crisis, excluding the Covid-19 disruption five years ago, according to Bain & Co.

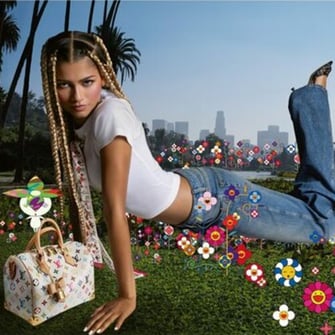

Companies are trying to find ways to reconnect with customers after price hikes, and one strategy is to bring in buzzy new designers who can inspire well-heeled shoppers to open their Louis Vuitton wallets once more. But top creatives must be the right fit with the brand and importantly, not overshadow the label on the bag or shoe.

The roots of the current creative schism lie in the bling boom-and-bust of the past five years. As consumers — particularly in the US — had little else to spend their money on from late 2020 to mid 2022, they turned to Rolex watches and Gucci handbags. When they began to tighten their belts in 2023, Chinese consumers, finally freed from stringent lockdowns, took their place.

Those waves of demand meant brands could push up prices. Erwan Rambourg, an analyst at HSBC Holdings Plc, estimates that since 2019, the average price of iconic products in Europe has risen by 54%.

Against this backdrop, there was little need to innovate. Along with the belief that luxury consumers would continue to pay ever higher prices, a kind of creative complacency set in too.

But for the past year or so, demand has contracted. This is where the appeal of a new lead designer comes in. One way to excite shoppers is by unveiling a revolutionary look, rather than cutting and pasting the classics. Fresh creative talent can be the catalyst for a slew of must-have products.

While top designers are highly paid — although this is rarely disclosed — if he or she can achieve this transformation, the payoff for the label can be enormous. Jean-Jacques Guiony, outgoing chief financial officer of LVMH, told investors in October that translating the creativity of its teams into commercial success was one of the most cost-effective growth drivers.

Perhaps the best example of how a talented individual can reignite a tired brand comes from Kering’s Gucci, under former creative director Alessandro Michele. A decade ago, his maximalism turbo-charged sales, helping to more than double Gucci’s revenue to €10.5 billion ($10.9 billion) in 2022, when he left.

But a new creative director can’t fix everything. Their vision is crucial in setting the overall direction, but how their products are merchandized — which pieces find their way into stores — and communicated to customers in advertising and marketing are also crucial.

Nor is a new designer’s influence instantaneous. It can take about 18 months for he or she to reach their full potential, assembling a team, going through the archives and developing their collections. With a radically new aesthetic, old stock must be cleared, weighing on margins. That may not be such a problem right now, as the luxury market is likely to remain rocky for the next year or so. But a designer must also be a good fit with a house’s overall ethos and the story it weaves around this, Daniel Langer, chief executive officer of consultancy firm Equite and executive professor of luxury strategy at Pepperdine University, told me.

And of course, no designer should be bigger than the name on the store’s door. “A smart brand beyond niche should not have star designers but a star team,” Flavio Cereda, portfolio manager for the Luxury Brands Fund at GAM Holding AG, said.

Take Hermes International SCA: Although Nadege Vanhee is creative director for the house’s women’s ready-to-wear range, it is still best known for its iconic bags. This may be one reason why Chanel has picked Blazy, a relatively young designer, rather than one of the industry’s heavy hitters like Slimane.

So which brands and designers should investors be watching particularly in 2025?

Chanel under Blazy is the obvious example. Although Chanel is owned by billionaire brothers Alain and Gerard Wertheimer, its fortunes have implications for listed peers, including Hermes and LVMH’s Dior. The privately held house has been one of the most aggressive on prices since 2019, with a large 2.55 flap bag up 91%, according to Rambourg’s analysis. It needs to reenergize and prove to customers that its double C logo is still worth the money. No wonder Bruno Pavlovsky, the head of Chanel’s fashion division, told The Business of Fashion that Chanel was “ready to let itself be transported.”

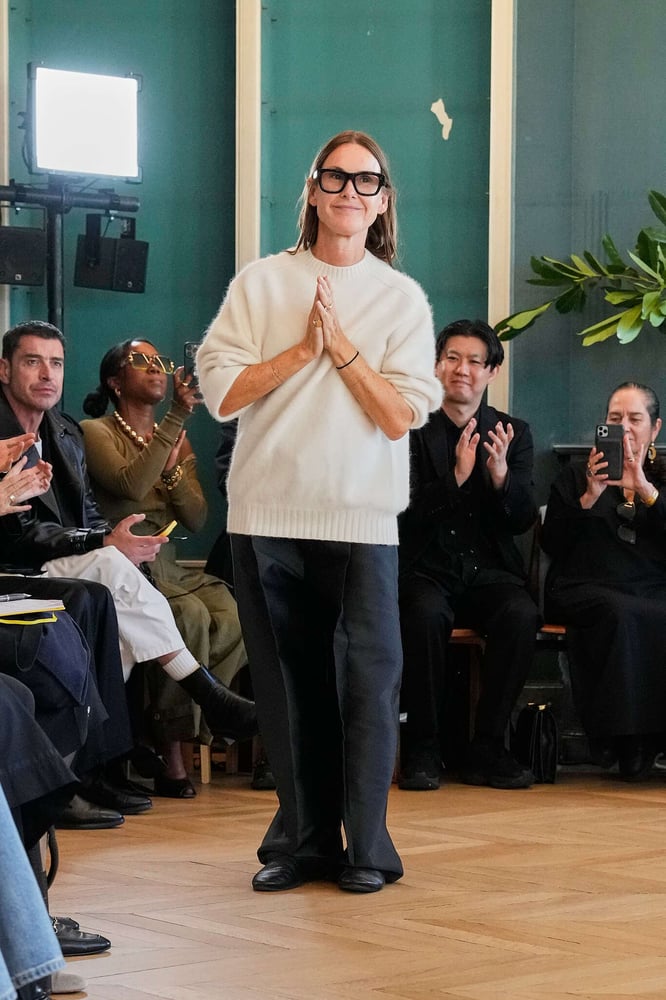

Kering’s Bottega Veneta has appointed Louise Trotter, creative director of Carven, to succeed Blazy. His departure is a blow to the French conglomerate, which is trying to revive Gucci. Bottega Veneta was the only one of its luxury houses to increase sales in the third quarter. Now, it too is in creative transition. But as Mario Ortelli, CEO of luxury advisory firm Ortelli & Co., told me: “When Chanel calls, it is like Real Madrid calling. No one can resist.”

Trotter won plaudits at Lacoste and Carven, but she has primarily worked in premium brands, with a focus on clothing. Bottega Veneta is pure luxury, with a heavy emphasis on accessories. It piles more pressure on Kering to fix its other houses led by Gucci.

In contrast, Celine has a good chance of thriving after Slimane. He set the tone, introducing menswear and embellishing bags with the double-C Triomphe logo. New designer Michael Rider, formerly at Ralph Lauren Corp., should be able to continue in this vein while adapting the aesthetic, much in the way that Anthony Vaccarello has done since succeeding Slimane at Yves Saint Laurent in 2016.

And of course, investors will be wondering where the next creative rupture might come.

Burberry Group Plc’s pivot away from trying to become Britain’s answer to LVMH and toward a combination of Ralph Lauren and Moncler SpA raises questions over whether Daniel Lee, the designer appointed by former CEO Jonathan Akeroyd, will remain. Given that Gucci has struggled to lift sales under Sabato de Sarno, the spotlight has also naturally turned to his tenure.

Assuming the typical stint of a designer is five to seven years, then Maria Grazia Chiuri, creative director of womenswear at Dior since 2016, is also worth watching. Sales at the house are slowing after spectacular growth, while LVMH is undergoing a series of management changes as CEO Bernard Arnault installs the next generation of leaders. Chanel’s outfit change could have implications here too.

Meanwhile John Galliano, Dior’s former creative director, has left Maison Martin Margiela, owned by privately held OTB Group. Where might he turn up?

But perhaps the biggest signal for investors will be when the designer merry-go-round stops spinning quite so quickly. That would indicate that the sector is stabilizing after its annus horribilis.

For while luxury and sport are moving ever closer — with LVMH’s sponsorship of the Paris Olympics for example — creative directors that resemble football coaches, moving on when results disappoint, are a bad look for an industry that prides itself on thinking long-term.

Copyright Bloomberg